Jobs in Abuja FCT

Jobs in Rivers State

Jobs in Oyo State

Jobs in Enugu State

Jobs in Edo State

Jobs in Kaduna State

Click here to see more states

Jobs in Abuja FCT

Jobs in Adamawa State

Jobs in Akwa Ibom State

Jobs in Anambra State

Jobs in Bauchi State

Jobs in Bayelsa State

Jobs in Benue State

Jobs in Borno State

Jobs in Cross-River State

Jobs in Delta State

Jobs in Ebonyi State

Jobs in Edo State

Jobs in Ekiti State

Jobs in Enugu State

Jobs in Gombe State

Jobs in Imo State

Jobs in jigawa State

Jobs in Kaduna State

Jobs in Kano State

Jobs in Katsina State

Jobs in Kebbi State

Jobs in Kogi State

Jobs in Kwara State

Jobs in Lagos State

Jobs in Nassarawa State

Jobs in Niger State

Jobs in Ogun State

Jobs in Ondo State

Jobs in Osun State

Jobs in Oyo State

Jobs in Plateau State

Jobs in Rivers State

Jobs in Sokoto State

Jobs in Taraba State

Jobs in Yobe State

Jobs in Zamfara State

SSCE/GCE/NECO Jobs

OND/NCE Jobs in Nigeria

HND Jobs in Nigeria

BSc/BA/BEng Jobs

LL.B/BL Jobs in Nigeria

B.Pharm Jobs in Nigeria

MBBS/MBBCh Jobs

MSc/MA Jobs in Nigeria

PhD Jobs in Nigeria

Administrative Jobs in Nigeria

Advertising Jobs Nigeria

Accounting Jobs in Nigeria

Auditing Jobs Nigeria

Arts Jobs in Nigeria

Android / IOS Developer Jobs

Agriculture Jobs in Nigeria

Architecture Jobs in Nigeria

Aviation Jobs in Nigeria

Automobile Jobs in Nigeria

Banking Jobs in Nigeria

Computer & InfoTech Jobs

Computer / IT Support Jobs

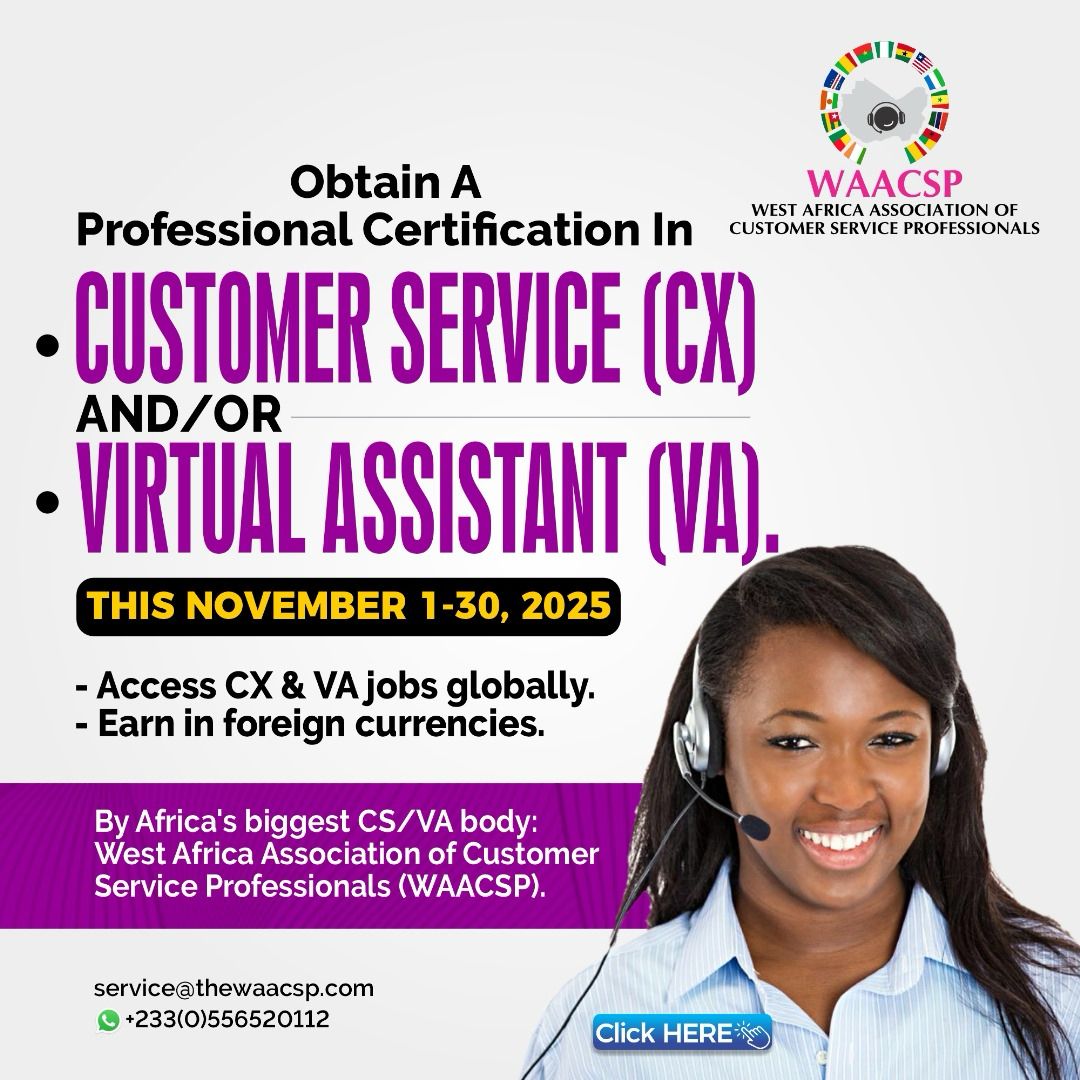

Customer Service Jobs

Civil Engineering Jobs

Cook / Chef Jobs

Database Jobs in Nigeria

Driving / Dispatch Rider Jobs

Education Jobs for Nigerians

Real Estate Jobs

Electrical/Electronics Jobs

Engineering Jobs in Nigeria

Facility Mgt Jobs in Nigeria

Finance Jobs in Nigeria

Front Desk Jobs in Nigeria

Geology Jobs

Government Jobs in Nigeria-

Graphics Design Jobs

Hospitality Jobs in Nigeria

Hotel Jobs in Nigeria

HR Jobs in Nigeria

Industrial Attachment (Internship)

Insurance Jobs in Nigeria

Journalism / Content Writing Jobs

Law Enforcement / Security Jobs

Lecturing Jobs in Nigeria

Law / Legal Jobs in Nigeria

Linux & Unix Jobs Nigeria

Marketing & Sales Jobs

Maritime & Shipping Jobs

Medical & Healthcare Jobs

Military Jobs in Nigeria

Computer Networking Jobs

NGO Jobs in Nigeria

Oil & Gas Jobs in Nigeria

Oracle Jobs in Nigeria

Personal Assistant Jobs

PHP & MySQL Jobs in Nigeria

Physician / Medical Officer Jobs

Public Relation Jobs

Programming / Software Jobs

Pri/Sec Sch Teaching Jobs

Real Estate Jobs in Nigeria

Remote / Work-at-home Jobs

Research Jobs in Nigeria

Safety & Health Jobs

Secretarial Jobs in Nigeria

Security Jobs in Nigeria

Sales Jobs

Shipping & Maritime Jobs

Student Jobs in Nigeria

Software Developer Jobs

System Admin Jobs in Nigeria

Teaching Jobs in Nigeria

Telecommunication Jobs

Semi-skilled / Factory Work

Volunteer Jobs Nigeria

Web Developer Jobs Nigeria

Web Designer / Frontend / UI Jobs

Eden Forever Decor Job Recruitment (4 Positions)

TMAsourcing Solutions Job Recruitment (5 Positions)

TeamAce Limited Job Recruitment (45 Positions)

Glovo Nigeria Internship & Exp. Job Recruitment (3 Positions)

Etcon Analytical and Environmental Systems and Services Limited Job Recruitment (4 Positions)

HRLeverage Africa Consulting Limited Job Recruitment (9 Positions)

NewGlobe Job Recruitment (8 Positions)

Federal University of Technology and Environmental Sciences, Iyin-Ekiti (FUTESIYIN) Massive Academic and Non-academic Job Recruitment (248 Positions)

OneBox Media Job Recruitment (4 Positions)

Royal Power and Energy Limited Job Recruitment (3 Positions)

Lead Enterprise Support Company Limited Job Recruitment (3 Positions)

Bluepeak Consulting Job Recruitment (6 Positions)

House Unlimited Land and Services Nigeria Limited Graduate Intern & Exp. Job Recruitment (6 Positions)

Synapse Resource Center Job Recruitment (3 Positions)

Hazon Holdings Job Recruitment (6 Positions)

Healthrite Pharmaceutical Supermarket Job Recruitment (3 Positions)

Esosa Food Systems and Innovations Limited Job Recruitment (6 Positions)

Strivo Labs Job Recruitment (3 Positions)

DO.II Designs Limited Internship & Exp. Job Recruitment (4 Positions)

S&P Global Commodity Insights Job Recruitment (5 Positions)

Sahara Group Job Recruitment

Federal University of Technology and Environmental Sciences, Iyin-Ekiti (FUTESIYIN) Academic Job Recruitment (105 Positions) - Part II

Mabest Academy Job Recruitment (3 Positions)

Palace Workers Solutions Job Recruitment (3 Positions)

Pem Security Services Job Recruitment (7 Positions)

Federal University of Technology and Environmental Sciences, Iyin-Ekiti (FUTESIYIN) Academic Job Recruitment (100 Positions) - Part I

Japan Tobacco International (JTI) Nigeria Impact-X (Internship) Programs 2025 (3 Positions)

Federal University of Technology and Environmental Sciences, Iyin-Ekiti (FUTESIYIN) Non-Academic Job Recruitment (47 Positions)

Westfield Energy Resources Limited Job Recruitment (3 Positions)

FlexFilms Limited Trainee & Exp. Job Recruitment (5 Positions)

Catalyst Path Consulting Job Recruitment (3 Positions)

Felton Energy Services Limited (FESL) Job Recruitment (23 Positions)

Jaza Energy Job Recruitment (4 Positions)

ReelFruit Job Recruitment (4 Positions)

SOLEVO Group Job Recruitment (3 Positions)

Reputable Training Academy Job Recruitment (4 Positions)

Transsion Holdings Job Recruitment (5 Positions)

Hyprops Nigeria Limited Job Recruitment (6 Positions)

Sundry Foods Limited Trainee & Exp. Job Recruitment (3 Positions)

Recore Limited Job Recruitment (3 Positions)

Glowfield International School Job Recruitment (3 Positions)

Federal University of Agriculture, Zuru Job Recruitment (3 Positions)

Lesso Group Job Recruitment (8 Positions)

First Excelsia Professional Services Limited Job Recruitment (4 Positions)

Owens and Xley Consults Job Recruitment (8 Positions)

Nabuyar Environmental Consultants Limited Job Recruitment (3 Positions)

Unified Payments Services Limited Job Recruitment (10 Positions)

Amaiden Energy Nigeria Limited Job Recruitment (12 Positions)

AG Trade Services Limited Job Recruitment (7 Positions)

Tax Management and Regulatory Compliance Team Lead at Hyprops Nigeria Limited

Posted on Mon 03rd Nov, 2025 - hotnigerianjobs.com --- (0 comments)Hyprops Nigeria Limited is a fully-owned Nigerian company which has provided oilfield support services to the oil and gas industry in Nigeria since 1997. At all levels, our strategic alliances and technical associations have been based on the changing dynamics for Oilfield Services Provision in Nigeria, in particular the increasingly "marine-based” nature of the industry in the country and our long-term strategy of vertical integration, to position us to support clients through the lifecycle of assets-through the development of conceptual designs, detailed engineering, construction and construction management, installation, pre-commissioning, commissioning, operations and maintenance and facility decommissioning.

We are recruiting to fill the position below:

Job Title: Tax Management and Regulatory Compliance Team Lead

Location: Lagos

Employment Type: Full-time

Job Purpose

- The Tax Management and Regulatory Compliance Team Lead is responsible for leading and overseeing the team that manages all tax-related activities of the company, and ensuring compliance within applicable regulatory and legal requirements.

- This role involves managing the organization's tax strategy, coordinating tax audits, mitigating tax risks, and ensuring accurate and timely compliance with state, national and international regulations.

- The Team Lead also acts as a key advisor on tax and regulatory matters, providing insights to optimize tax efficiency and reduce liabilities while maintaining a strong compliance framework

Job Description

- Designs, implements, and continuously reviews tax planning strategies to optimize the company’s tax position, ensuring compliance with applicable tax laws and regulations while identifying opportunities for tax savings and efficiency.

- Coordinates the preparation and filing of tax returns, ensuring accuracy, completeness, and compliance with applicable tax laws and regulations. Oversees the timely submission of all required

- documentation, while addressing any discrepancies or queries from tax authorities to avoid penalties and maintain the organization’s compliance record.

- Periodically conducts comprehensive tax compliance assessments across the entire company to ensure adherence to applicable tax laws, regulations, and internal policies, while identifying and

- addressing any potential risks or discrepancies.

- Leads the development of the company’s tax strategy, ensuring alignment with financial goals, optimizing tax efficiency, and minimizing liabilities to support the organization’s overall financial health.

- Ensures that Corporate Income Tax (CIT) and other related taxes are filed accurately and on time, sustaining compliance and preventing penalties, thereby securing financial stability for thegroup.

- Advises senior leadership on tax planning decisions to reduce liabilities and enhance profitability, contributing to better financial outcomes and improved decision-making.

- Monitors changes in tax regulations and identifies impacts on business operations, ensuring compliance and recommending adjustments that optimize tax outcomes while enhancing operational efficiency

- Maintains 100% compliance with all applicable tax laws and regulations, proactively managing risks and ensuring no disruptions to business operations due to regulatory noncompliance.

- Identifies and mitigates tax risks, developing strategies to address these issues and supporting the company’s financial health by safeguarding against potential financial loss.

- Oversees the timely filing of taxes, ensuring deadlines are met and taxes are filed accurately, streamlining the process to avoid any operational delays.

- Leads and mentors the tax team, fostering a collaborative environment that encourages growth and development, thereby increasing employee engagement and retention.

- Empowers the team by providing them with training on current tax regulations, compliance practices, and best strategies, improving their performance and enhancing their professional development.

Job Specification

- Bachelor’s Degree in Accounting, Finance, or Economics (Master’s degree is preferred).

- Professional certification such as ICAN, ACCA, CITN is mandatory.

- 6 - 8 years of experience in tax management, regulatory compliance, or a similar role, with at least 3 years in a leadership position.

- Experience in the oil and gas or industrial sector is preferred

Application Closing Date

Not Specified.

How to Apply

Interested and qualified candidates should send:

Click here to apply online

University of Uyo (UNIUYO) Massive Graduate and Exp. Academic and Non-Academic Job Recruitment (49 Positions)

Southwestern University Nigeria Massive Academic and Non-Academic Job Recruitment (88 Positions)

University of Ibadan (UI) Massive Academic and Non-academic Job Recruitment (372 Positions)

Federal University Oye-Ekiti (FUOYE) Massive Graduate and Exp. Academic and Non-Academic Job Recruitment (384 Positions)

Nigerian Air Force List of Successful Candidates for Direct Short Service Commission Course (DSSC) 34 / 2025 Zonal General Aptitude Test

Federal University of Health Sciences, Otukpo (FUHSO) Massive Academic and Non-academic Job Recruitment (384 Positions)

MTN Global Graduate Development Programme - Nigeria 2026

Dangote Cement Management Trainee Programme 2025

Nigerian Air Force (NAF) Basic Military Training Course 46 / 2025 (Airmen and Airwomen) - 38 Positions

Access Bank Plc Entry Level Training Program 2025

Ecobank Nigeria Entry Level Development Programme (ELDP) 2025

Nigerian Army Massive Recruitment for Trades / Non Tradesmen & Women Nationwide (90 Regular Recruits Intake)

FSDH Merchant Bank Limited Management Associate (MA) Program 2025

Management Trainee at Reckitt Benckiser Group Plc